Employee Benefits

Ensuring your employee benefits are just that – a benefit – is vitally important. Our structured approach, combined with our extensive experience, enables us to achieve this for you, while also making sure the solution we create is cost effective.

We create employee benefits solutions that are tailored to your precise needs and help you deliver your strategic HR and business objectives. You'll also benefit from our transparent fee structures that offer cost certainty, dedicated support and agreed service levels.

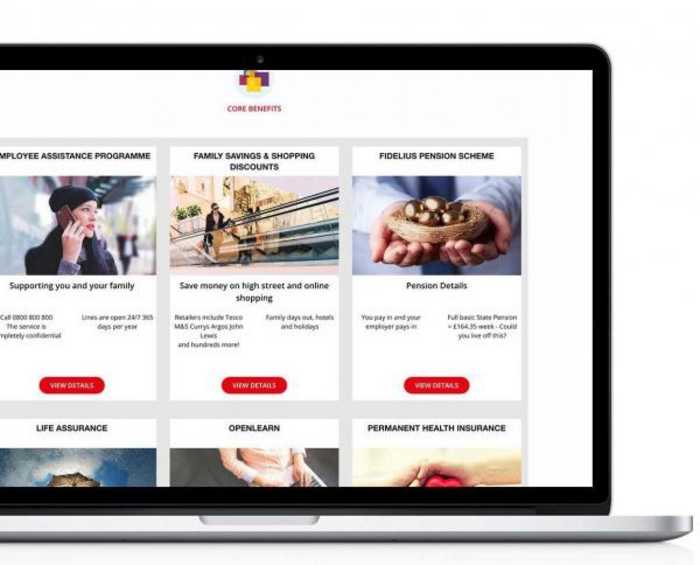

Benefits Platform

Each of the Fidelius Employee Benefits consultants is equipped and experienced to provide holistic solutions for businesses, and now these are enriched by the Fidelius Benefits Platform which makes it far simpler for employees to remain aware of their benefits and to get the most from them.

Flexible Benefits

Our consultancy experience and knowledge of this market ensures that your benefits programme is designed perfectly and runs on absolutely the correct platform for your needs from start to finish. Being platform agnostic too, means that you can be assured that we are working to your agenda and not vice versa.

Health & Wellbeing

Wellbeing initiatives can be massively varied but rest assured you can count on us to provide you with the knowledge and support you need in analysing, designing and implementing programmes to meet your objectives.

Group Risk

Fidelius specialises in Group Life, Group Income Protection, Group Critical Illness, Private Medical Insurance and other forms of healthcare to ensure you get the right cover, structured and priced correctly to fit with your requirements.

Auto-enrolment

Whether it’s holding your hand through your auto-enrolment obligations or figuring out if things could be done better as part of a review or through the re-enrolment process, our highly experienced auto-enrolment team can offer you the support you need to save you time and money in trying to go it alone.

Legislation requires employers to automatically enrol employees into an Auto- enrolment Qualifying Pension Scheme (AEQWPS) and make at least the minimum level of contributions on their behalf.

We offer a number of auto-enrolment services to assist you with both initial and on-going compliance. These can include:

- Identifying and establishing an AEQWPS

- Liaising with your payroll team/provider to ensure all employer duties are being met

- Providing additional communications for your employees

- On-site pre and post enrolment employee engagement

- Assistance with filing of required information with the Pensions Regulator to include Declaration of compliance

- Ongoing annual compliance and Governance review service

Employee Engagement

We’ll help you make sure that your employees understand and value their employee benefits by improving engagement through effective communication.

Governance

Our pensions team live and breathe pension scheme governance to ensure the best outcomes for you and your employees – with the data flow feeding other areas of reporting and support for you. From new schemes to existing scheme reviews, we're here to help you.

Governance drives our member communication and engagement by generating appropriate strategies to deliver the right messages to the right members at the right time.

Robust governance delivers legislative compliance, value for money and good member outcomes, constantly holding the scheme provider to account.

Pensions & Benefits

To attain a true return on your investment in pensions and benefits, you need to be sure your employees really understand and value them. We help you achieve this.

Our collaborative approach to employee benefits solutions, mean that they are tailored to you and your employees' needs. We have a variety of methods to help you deliver your strategic HR and business objectives, meaning we can achieve measurable employee engagement and return on your investment across any logistical or geographical challenges. We can deliver:

- 'Whole of market' with access to all approved providers for each of your benefits

- Employee understanding and awareness on-line benefit surveys

- Benefit platforms to host your total benefits

- Total Reward Statements

- Financial education

- Targeted communications via multi media

- Face to face employee guidance and/or advice

- Formal pension scheme governance reporting

- Remuneration options to suit you

Company Pensions

For many employers, their workplace pension scheme is one of the biggest budget items when it comes to employee reward. However, very few employers are maximising their pension strategy and are therefore failing to achieve the value they could from their scheme. Our strategic consulting services can help you make sure that you have the right schemes, best structure and most effective scheme governance and communication processes for your particular workforce and specific business objectives.

Financial Education

Our workplace delivery team are here for your employees to lean on by delivering onsite the right messages, support and contact to the right members at key moments in their working lives. Whether seminars, 'lunch and learn' or one-to-one meetings, the feedback is always fantastic.

We work with you to ensure that we create an understanding and well informed workforce which leading to financial wellbeing and appreciative employees