One of the most effective methods of saving for retirement is through a pension plan provided by your company. There are two main reasons for this: Firstly, the company will pay money into the plan for you, meaning you won’t just benefit from your own contributions, you’ll also receive the benefit of your employer’s contribution as well. Secondly, you’ll enjoy tax relief on your contributions.

Pension contributions paid by your employer are exempt from National Insurance. So, if you agree to a reduction in your salary equal to your own pension contributions, your employer in return will agree to pay additional pension contributions of an amount equal to the reduction. This means that you save the National Insurance you would otherwise have had to pay on your pension contributions.

This is what is known as Salary Exchange (or Salary Sacrifice)

In other words, it means that the payments you agree to make to the plan are taken from your salary each month, before tax or National Insurance Contributions are deducted.

What is Salary Exchange?

Salary Exchange is a method of making contributions to your employer’s pension scheme.

Many people decide to make Salary Exchange pension contributions in order to benefit from savings made by reducing your National Insurance contributions (NICs).

Salary Exchange also enables higher and additional-rate taxpayers to make full tax savings on pension contributions immediately, rather than having to reclaim 20% or 25% respectively by way of their self-assessment tax return or a change in tax coding.

How salary exchange benefits me?

As an individual/employee

- The reduction in your gross salary means you pay less NICs because you do not pay NICs on the Salary Exchange pension contribution.

- There is no need to fill in forms or complete a tax return to claim back higher or additional rate tax relief.

- Salary Exchange is a more cost-effective way of you saving for retirement.

As a business owner/employer

- Reducing your Employer NICs as your contribution is based on employee’s reduced salary.

- These savings can help contribute towards other employee benefits for your members of staff, boosting your employee wellbeing.

Key phrases to know

Gross Salary or gross pay – your pay before any deductions for income tax and NICs

Net Salary or net pay – your pay after all deductions such as income tax and NICs have been made; this is your ‘take home’ pay.

Post-Exchange Salary – your pay after deductions of your Salary Exchange pension contribution; this becomes your new contractual salary.

Reference Salary – your pay before you decided to make a Salary Exchange pension contribution; your reference salary will continue to be used to calculate salary related benefits such as future salary increases.

Your employer’s Salary Exchange scheme

Each Salary Exchange scheme can be structured differently, and the specific details of the scheme offered by your employer will be provided separately. Please note that the pension contribution levels and salaries used in this guide are provided as examples only. The actual contribution levels and other terms applying to your employer’s pension scheme are given in your pension scheme documents.

Remember, after reading this article, if you have any questions or would like any further information, Fidelius are here to help you: eb@fidelius.co.uk

Salary Exchange savings

Employee contributions to group pension schemes receive income tax relief at the highest marginal rate paid – basic, higher or additional in the UK, or basic/intermediate/higher/advanced/top for Scotland. In order to receive tax relief, your contributions must remain within the Annual Allowance.

The Annual Allowance is the maximum amount that can be tax-efficiently paid into pensions every year. For most people it is £60,000 for the current tax year.

However, for people who have an adjusted income of £260,000 or more, the £60,000 annual allowance decreases on a tapering basis to £10,000 for those earning more than £360,000. People aged over 55 who have withdrawn pension savings above their tax free element using flexible access rules have a reduced Annual Allowance of £10,000. This is known as the Money Purchase Annual Allowance.

Please contact Fidelius if you have any questions about your Annual Allowance.

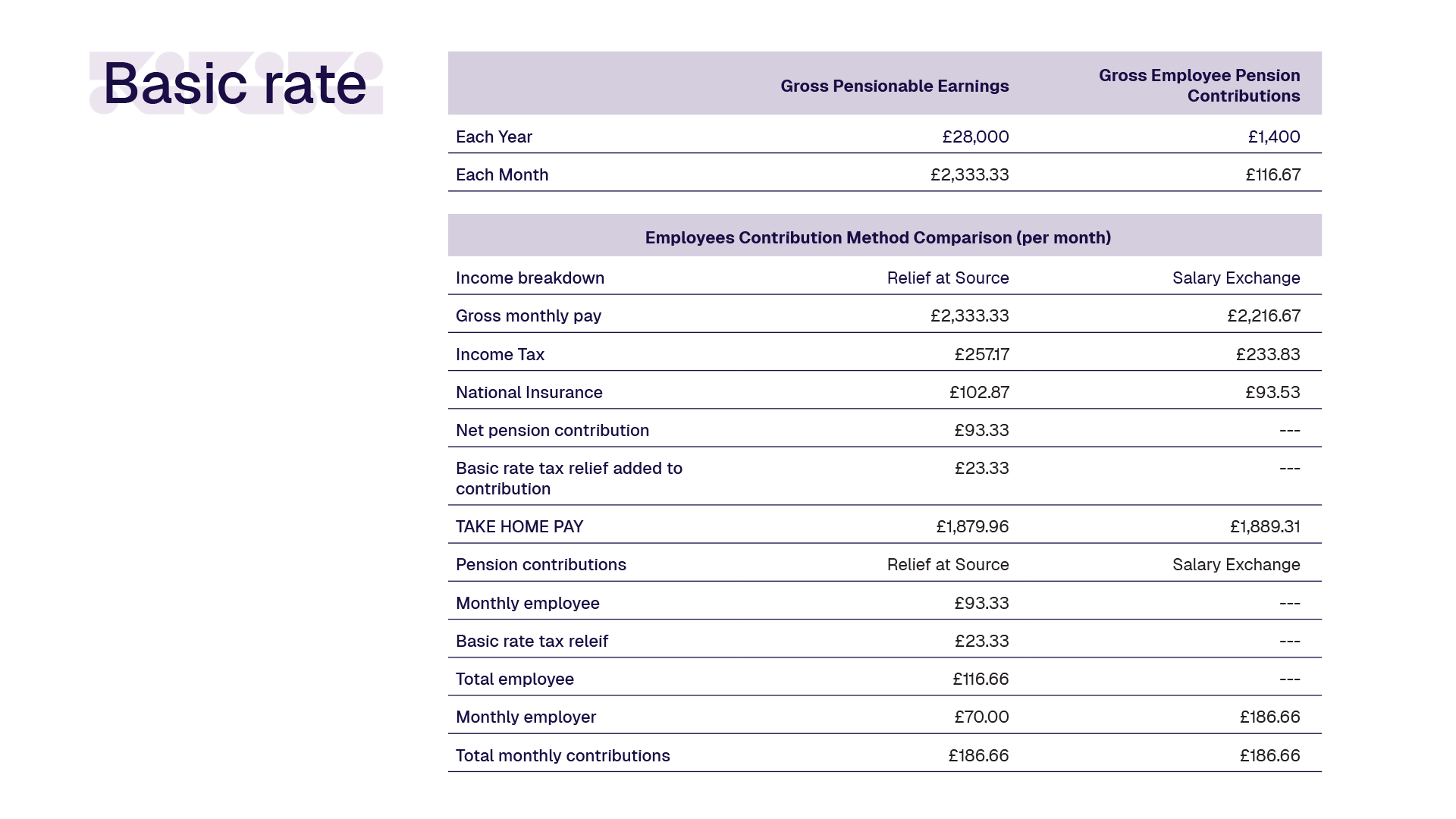

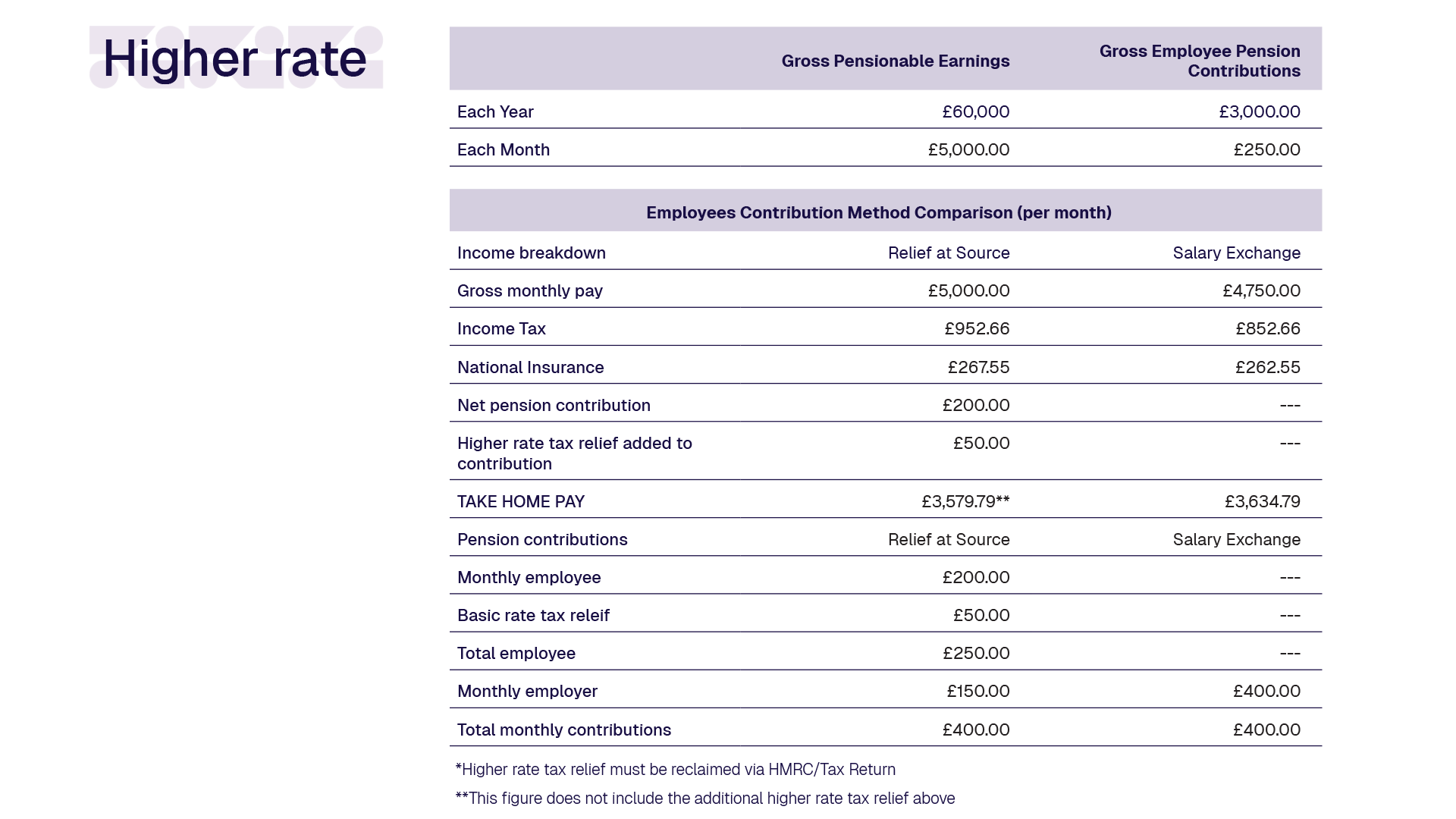

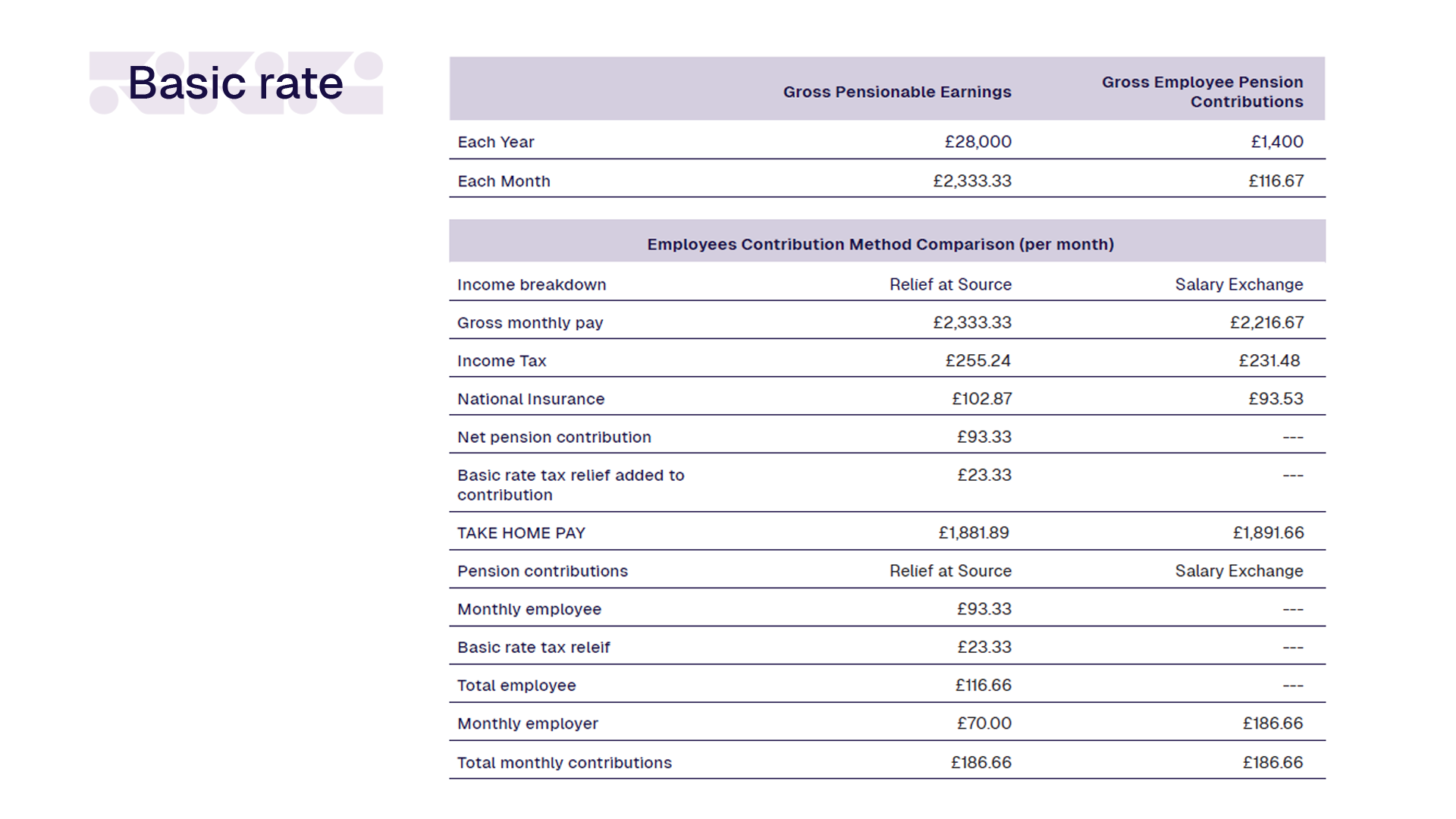

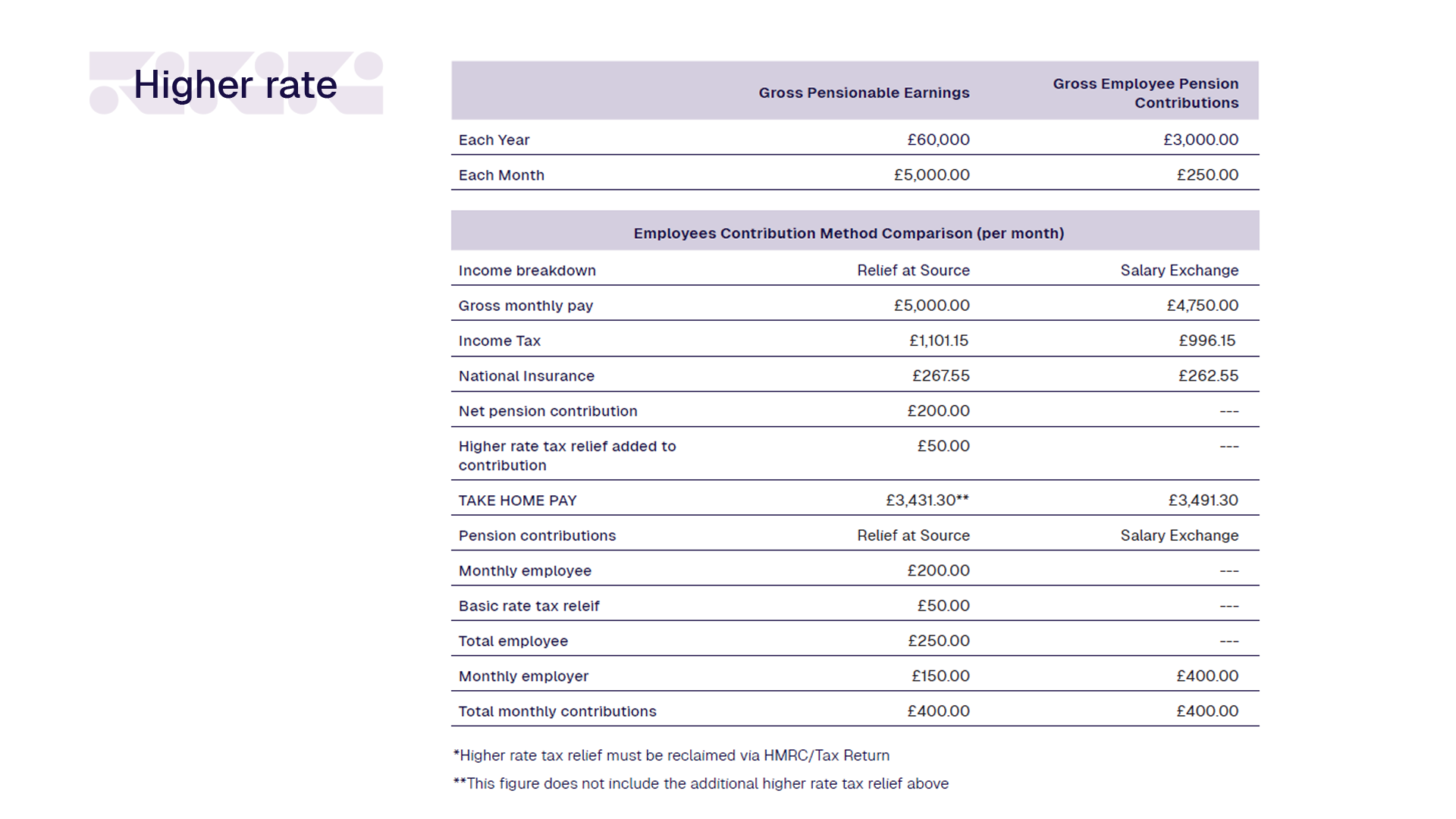

The savings you can make via Salary Exchange are illustrated in the examples on the next two pages. The exact level of income tax and NIC savings you will make through Salary Exchange pension contributions will depend on your individual circumstances, your earnings and the amount you choose to save for retirement each month.

The examples on the next two pages concentrate on the savings you can make by using Salary Exchange. They do not take into account employer contributions you are entitled to. Your employer’s contributions will be shown on the pension documents you have been sent.

The below tables show the Salary Exchange for basic and higher rate taxpayers. For comparison purposes, we have also included an example showing how a traditional pension contribution would work.

UK Taxpayers

Scottish Taxpayers

It is also important to understand that Salary Exchange isn’t for everyone. Whilst there are some circumstances where it is effective, there are some where it is not.

Some considerations on Salary Exchange:

- Salary Exchange must not reduce remuneration below the National Minimum Wage/National Living Wage (NMW/NLW).

- Salary Exchange is not beneficial for non-taxpayers. Pension contributions made by non-taxpayers receive basic tax relief (20%), which exceeds the National Insurance saving made via Salary Exchange (8%).

- Entitlement to some State Benefits is based on the amount of National Insurance contributions paid and others on the amount of earnings therefore Salary Exchange could therefore affect current or future entitlements.

Learn more

Reach out to our Employee Benefits team at eb@fidelius.co.uk to learn the full range of benefits Salary Exchange could offer you.

Disclaimer

This article is provided for informational purposes only and does not constitute financial advice. You should seek independent financial advice if needed. Tax and legislation rules are based on the time of printing and may change at any time in the future.