With headlines full of falling stock markets, we wanted to share a few thoughts with you.

We don’t believe in reacting to short-term news when making investment decisions — and even at the time of writing and publishing this, markets may have already moved again.

That’s why we often say the best approach is to stay focused and avoid the noise. That said, we understand that seeing markets fall can feel unsettling.

What’s happened:

On 2nd April, Donald Trump signed an executive order introducing new tariffs on goods imported into the US. While tariffs were expected, the rates were higher than markets had forecast. A base tariff of 10% now applies to all countries, with additional charges for those running a trade surplus with the US.

China responded with a 34% levy following Trump’s 54% tariff. EU goods will face a 20% tariff, Japan 24%, and Vietnam 46%. The UK was given the base rate of 10% (BBC, 9 April 2025). Already we’re seeing changes to these tariffs and a pause from the Trump administration which is causing a lot of reaction in markets.

When first announced, global markets, especially US shares, fell sharply. The S&P 500 — which tracks the 500 largest US companies — dropped 4.84% the day after the announcement (CNBC, 3 April 2025). This was its worst single day fall since the 2020 pandemic. UK and European stocks also declined, though less dramatically. Global bonds helped cushion the impact.

This highlights the value of a well-diversified portfolio and the role of active management in navigating market volatility.

The market reaction reflects concern over slower global growth and rising inflation due to disrupted trade. Some economists are now forecasting a US recession — though many of their models don’t account for such tariffs. At this stage, it’s too early to say what the full impact will be on businesses and consumers.

A reminder on markets

Markets dislike uncertainty — it often leads to volatility, where prices move up and down sharply. This can make short-term predictions difficult.

Since President Trump’s return in 2025, there’s been a wave of political and economic changes, including tariffs, tax cuts, deregulation, and shifts in government spending. These have added to trade tensions and unsettled markets.

Markets are influenced by many things: economic data, political events, and investor sentiment — all of which can change quickly and unexpectedly. Forecasts often rely on assumptions that don’t hold up in the face of surprise events.

On top of that, policies can be reversed, adjusted at short notice or paused (like we’ve just seen at the time of writing), adding to the uncertainty.

That’s why we don’t believe in trying to time the market — deciding exactly when to buy or sell. It’s too complex, with too many moving parts.

What are we doing?

We closely monitor a defined list of investment portfolios that we recommend to clients. These are regularly reviewed — and during periods of market uncertainty, we pay even closer attention.

Our portfolio managers keep a close watch on markets, distinguishing meaningful signals from short-term noise. They only make changes when they believe it’s appropriate, guided by their experience, deep research, and a wide range of data.

They also have tools available to adjust how portfolios are positioned — aiming to manage risk and make the most of opportunities. These decisions are always made with your long-term objectives in mind.

What should you do?

In short — nothing. Markets have been relatively calm for some time, so this period of volatility may feel like a shock. But it’s a normal part of long-term investing.

It can be tempting to move into cash during downturns. But doing so means needing to predict both when to get out and when to get back in.

In our experience — and supported by research — that’s incredibly difficult to get right and often leads to missed opportunities.

We know times like these can feel unsettling. That’s why we recommend diversified portfolios designed to handle different market conditions.

It’s also why we believe investment decisions should be based on your long-term financial plan — not short-term headlines.

Consider these points:

If recent events have left you feeling uneasy, it’s worth asking yourself a few key questions:

- Have my long-term financial goals changed?

- Has my income or expenses changed significantly?

- Have I experienced a major life event (job loss, illness, divorce, inheritance)?

- Do I have an emergency reserve of cash on deposit (often 3 months income/6 months expenditure)?

- Am I reacting emotionally to news or short-term market movements?

- Would I regret missing out if markets recover shortly after I sell?

- If your answers to any of these questions are different from before the recent market falls, get in touch.

- We’re here to talk it through and help you decide on the best next steps.

Investing over the longer term

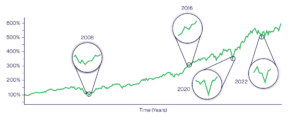

This chart is a reminder of why long-term investing works.

Zoom in on any one moment — like 2008, 2020 or 2022 — and the journey can feel rough. But zoom out, and the long-term trend becomes clear: markets have rewarded patience.

Over the 20 years from 2004 to 2024, markets faced major events — the Global Financial Crisis, Brexit, Covid-19, and the war in Ukraine. Yet a globally diversified portfolio stayed resilient and continued to grow over time.

This chart shows the performance of a global equity fund — one example of how long-term investing can work despite short-term noise.

Source: HSBC Global Equity Fund – The Last 20 Years: A Reason for Investing? – Published 2024

This guidance is based on our current understanding of global markets, which may change at any time. It is intended for informational purposes only and should not be considered financial advice. Investment markets can go down as well as up.