Have you ever thought why someone buys what they do?

Why do some people pay a handyman to hang a picture, while others insist on doing it themselves? Why are some frugal on essentials strawberry jam but splash out and drive a Porsche? Our spending habits are personal and often contradictory. But they reveal something deeper: what we value, what we prioritise, and what kind of lifestyle we expect. That’s why knowing your retirement number matters.

Based on a survey commissioned by the Department for Work and Pensions in 2024, 41% of UK adults aged 40–75 say they have ‘no idea’ how much income they’ll need in retirement1.

Our spending habits aren’t just quirks; they’re clues to what matters most to us. And that matters when planning for retirement. Importantly, there is no right or wrong, but rather simply being aware that these decisions reflect your lifestyle, and your lifestyle shapes how much you’ll need in retirement

The State Pension, currently £11,973 a year (August 2025 at the time of writing), provides a foundation. But for most, it’s not enough to maintain the lifestyle they’re used to.

So how do you find your number?

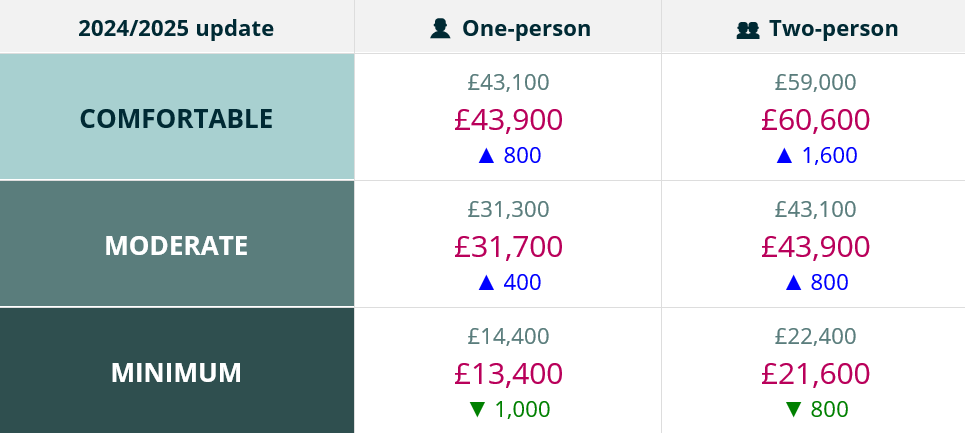

Well, one method is to look to see what on average people spend. Each year the Pensions and Lifetime Savings Association (PSLA) gives an indication of how much retirement will cost in today’s money (not accounting for future inflation changes). This is called the Retirement Living Standards (RLS).

Source: Retirement Living Standards. Standards are the property of and provided by the PLSA and Loughborough University. https://www.retirementlivingstandards.org.uk/

The expenditure above assumes that you have no renting or mortgage costs in retirement.

Minimum standard (£13,400/year): Covers essentials like food, utilities, and basic social activities. Think: budget holidays, no car, and limited dining out.

Moderate (£31,700 / year): Adds more flexibility: a car, European holidays, and some leisure spending.

Comfortable (£43,900 / year): Offers greater financial freedom: regular holidays, generous gifts, and more choice in lifestyle.

These figures are for single retirees and assume full State Pension entitlement. Couples will need more, but economies of scale apply. These figures are based on the cost of retirement and are not an income level. They do not account for any income tax you may pay on your pension or any care costs which needs to be planned for too. Depending on where you live, some areas may have higher or lower costs than others.

How do these sound to you? Too high? Too low? Everyone’s number is different — and that’s the point.

How long is a piece of string?

Do the PSLA standards help with setting a savings target? Well yes and no. We believe that the above could be used as a starting point to give a yard stick or benchmark to stick to if you’re unsure. But really, the best way of determining how much you need is to find out about you. And the PSLA agrees with this too, stating that “Those making use of the Standards as a planning tool are encouraged to tailor them to their lifestyle, combining aspects from different levels”.2

Numbers can change

For someone starting out their savings and investing journey, we appreciate that planning what you need in many decades time is difficult to envisage. That’s why having a number — even a rough one — is essential. It gives you:

- Clarity about what you’re aiming for

- Peace of mind that you’re on track

- Confidence to invest and plan with purpose

How we help

- Explore your preferences — what matters most to you in retirement. Whether it’s travel, security, helping family, or simply peace of mind, we use a mix of soft questions and visual tools to guide the conversation.

- Build a picture using our interactive tools – From there, we build a picture of your financial future. Using interactive visuals, we show how your income, spending, and savings might evolve over time.

This isn’t just about numbers — it’s about your story.

So, do you know your number? If not, let’s work it out together. Speak to one of our advisers and start planning with confidence.

Disclaimers

This article is for guidance purposes only and does not constitute financial advice.

Tax treatment depends on individual circumstances and may be subject to change in future.

Sources:

- https://www.gov.uk/government/publications/planning-and-preparing-for-later-life-2024/planning-and-preparing-for-later-life-2024)

- PSLA Living standards https://www.retirementlivingstandards.org.uk/library/2025-rls-update Accessed 7th August 2025