The recent Bank of England Interest rate cut to 4.00% sparked positivity in the housing market, with the rate reaching the lowest level since March 2023, helping encourage fixed rate deals to also reduce.

Whilst we’re currently experience a buyers’ market, what is the bigger picture looking like?

General market trend

The general interest rate trend over the last year has been downward, with 2-year fixed rates particularly being lower than they have been. For a period, we were seeing 5-year fixed rate maintaining an edge, but now we are seeing 2-year rates becoming cheaper or in line with the 5-years.

This is helping to give buyers more options when deciding their next length to fix their mortgage on, especially those who are optimistic about further rates in the coming years and want to take advantage of what could be lower rates in a couple years’ time.

This is off the back of The Bank of England, who started to cut the base rate from August 2024. We are now down to base rate of 4.00% at the time of writing this, following a 0.25% reduction on the 7th of August.

With regards to what could happen in the coming months, different economists have different views, with some believing we may see the base rate anywhere between 3.5%-3.75% by the end of 2025.

What does this mean for house prices?

Currently, we’re in a buyers’ market, with lots of first-time buyers taking advantage of falling rates.

But the sale and purchase market has been slower. The stamp duty changes earlier in the year caused an influx at the time, but it’s since dropped off a little.

The average UK house price via Nationwide has increased by 0.6% in July, now sitting at £272,664 compared to £271,619 in June. Key regional drivers of this growth were in the Northeast of England, Northern Ireland and Scotland. Prime Central London fell by up to -3% in some areas.

Residential mortgage rates

![]()

Source: Santander UK, August 2025

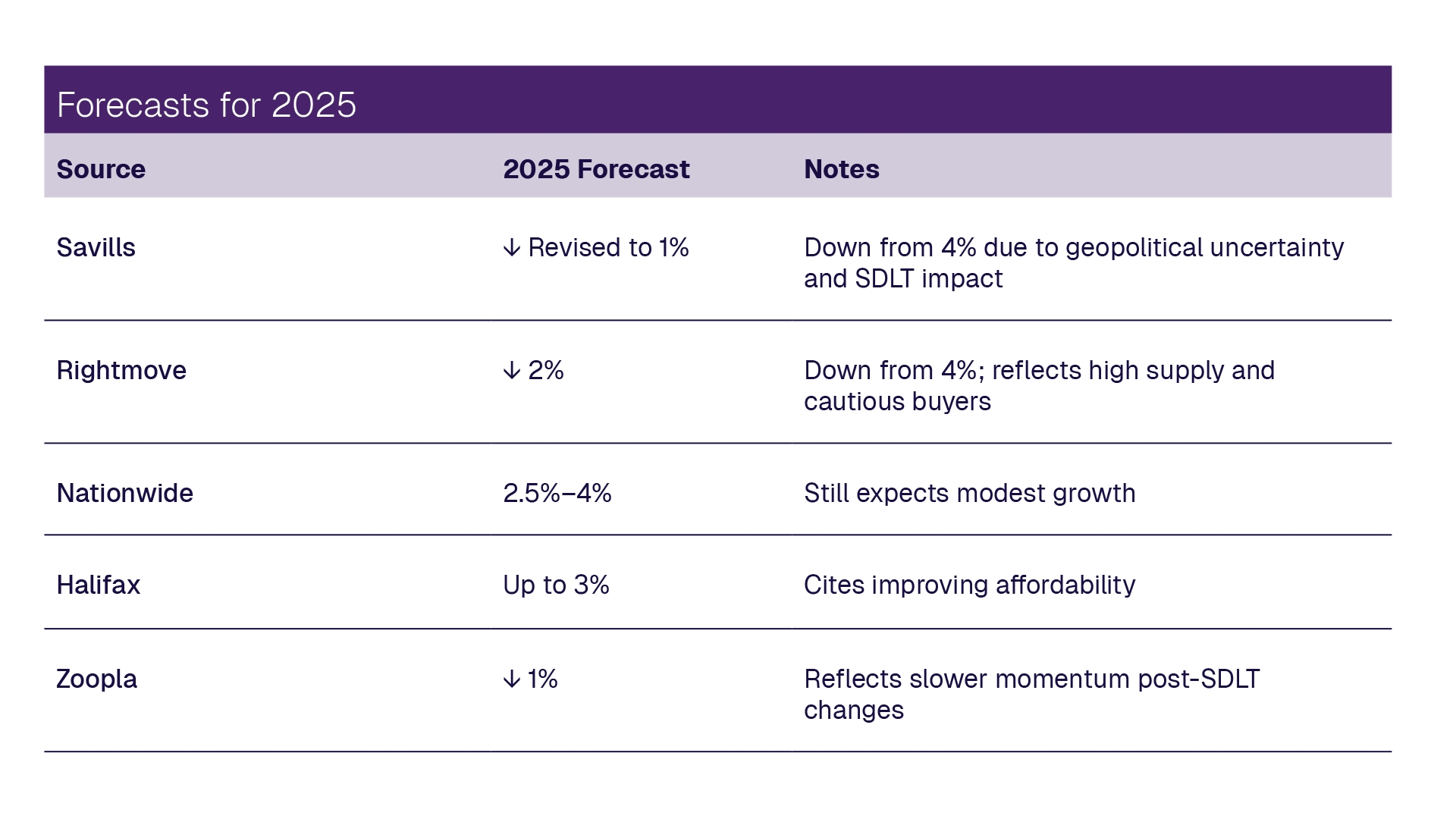

What might the year ahead look like? – Market outlook

The overall market outlook is positive; rates are on the right trajectory, we’re seeing more flexibility from lenders, and innovation for first time buyers trying to get on the ladder.

Total gross mortgage lending is expected to reach £260billion, which is up on 2024 at £237.5billion – although we need to get there yet!

As with previous years more and more clients aren’t remortgaging and tending to take up a new rate with their existing lender, which shows in the national figures that remortgage has declined.

Buy to let lending is starting to recover with lenders introducing very low interest rates but with high arrangement fees. It allows the lender to apply a lower stress rate on the rental calculation coverage meaning slightly higher LTV’s fit. It’s not what it once was, but it’s helping to keep things moving. We’re seeing more clients transferring property into an SPV, which also tend to have preferential stress testing allowing for more borrowing, with the arrangement fees being able to be offset for tax in the company.

FCA Changes

In July, the FCA allowed lenders to adjust the amount of business they’re able to do over 4.5x loan to income ratios. This has increased from £100m to £150m which should in theory allow more borrowing at a higher loan to income ratio. Lenders have started to react to the changes, with some implementing this through August.

Halifax have already seen some slightly higher borrowing levels being offered to customers in the space of a week now their affordability has been tweaked on the online system.

Hopefully, others will follow suit over the next month. We’ve yet to see this put into practice yet, but the FCA have also announced if a customer wishes to reduce the term of their mortgage the lender is no longer required to run a full affordability assessment.

There should also be more flexibility around remortgaging, if a customer can evidence, they’re paying more on their current deal a new lender should be able to provide a more flexible approach to the affordability checks if it doesn’t quite meet their internal criteria – which seems a more common-sense approach. So far, we’ve seen Barclays apply this, with hopefully more to follow.

Disclaimer

Your home may be repossessed if you do not keep up repayments on your mortgage. This article is for information purposes only and does not constitute financial advice. For advice, please contact one of our mortgage advisers or your financial planner.

Sources

Source: Santander UK – https://www.santanderforintermediaries.co.uk/products-and-criteria/latest-mortgage-rates/ August 2025